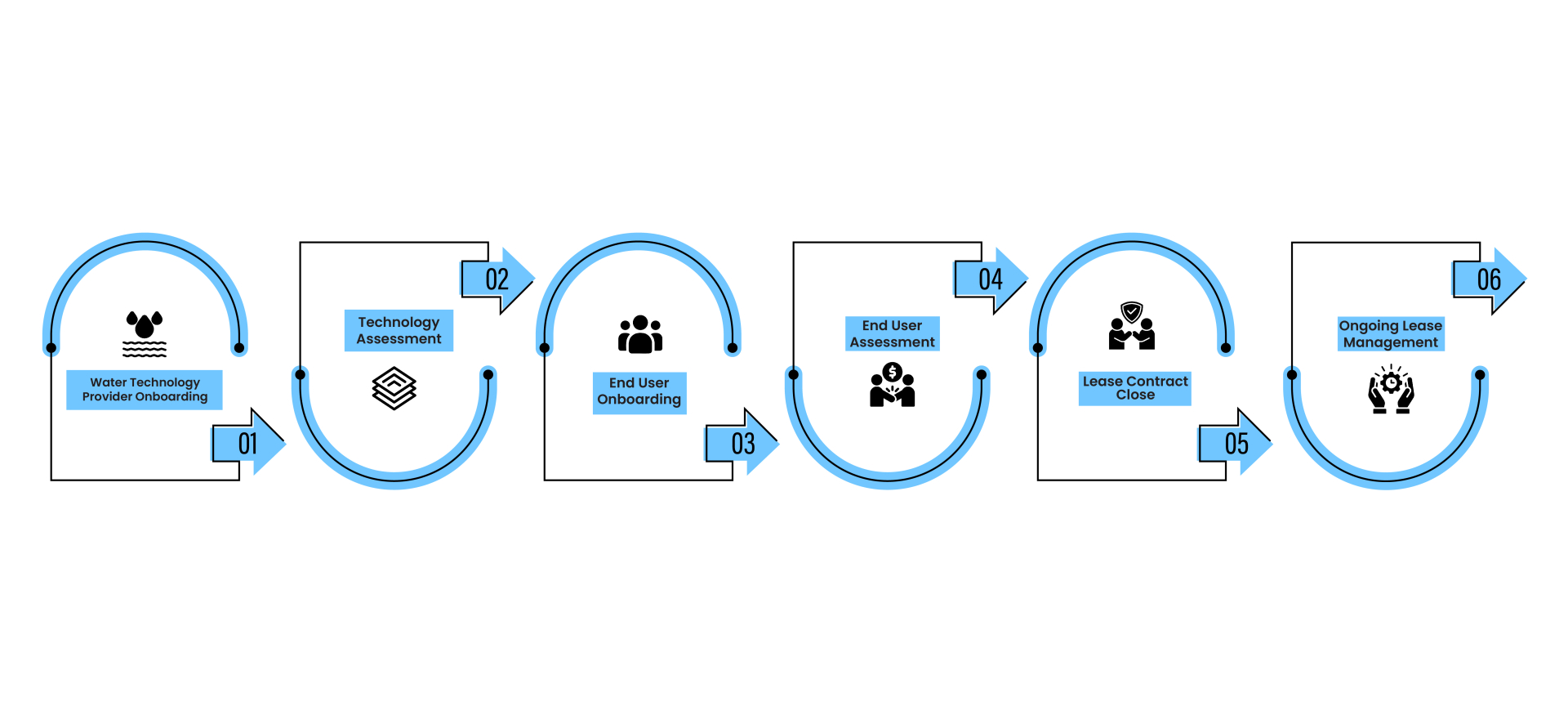

Our proprietary fintech platform digitizes and standardizes the water asset leasing lifecycle, featuring:

We acquire water assets from Water Technology Providers and lease them to end-users which allows these assets to be paid for using Operating Expenditure instead of Capital Expenditure